Recent decision of Swiss Federal Administrative Court (see 2C_895/2013) has a dramatic impact on how foreign hybrid business entity is classified for fiscal treatment in Switzerland. This particular case concern US limited liability company (LLC) but extends far beyond.

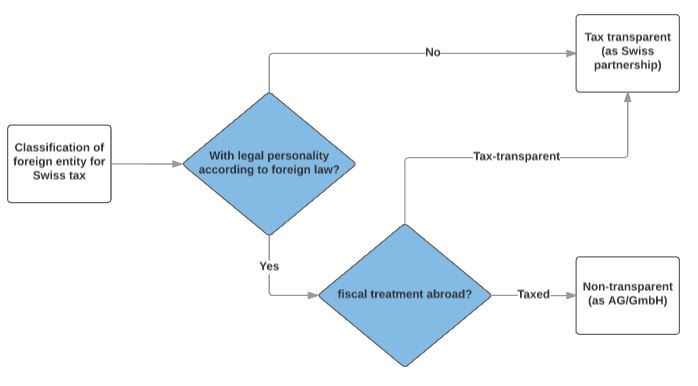

Key issue impacting taxation is whether a foreign entity is transparent for fiscal purposes (as Swiss partnership) or a legal person (like stock corporation (AG/ SA) or limited liability company (GmbH/Sàrl)). Continue reading New rules – Swiss tax perspective on foreign entities